how much did you pay in taxes doordash

You are responsible for keeping track of your profits as an independent contractor delivering for DoorDash. This is a 153 tax that covers what you owe for Social Security and Medicare.

Doordash Driver Review How Much Money Can You Make

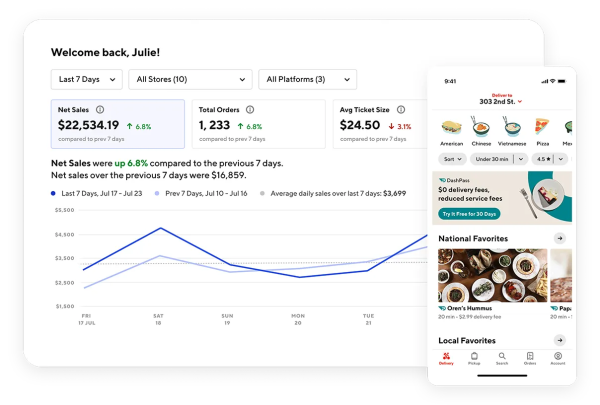

In some regions we offer DashPassa subscription program that offers a 0 delivery fee and reduced service fees for subscribers when ordering 12 or more from any DashPass-eligible.

. Br The 2018 tax year. When do you have to file DoorDash taxes. However you may now be wondering what the process is for filing DoorDash taxes in 2022 to ensure you cover any tax liability.

However you may now be wondering what the process is for. Dashers pay 153 self-employment tax on profit. How much does DoorDash pay drivers.

As of the first of January the rate for 2018 was 184. Do you have to pay DoorDash taxes under 600. The self-employment tax is your Medicare and Social Security tax which totals 1530.

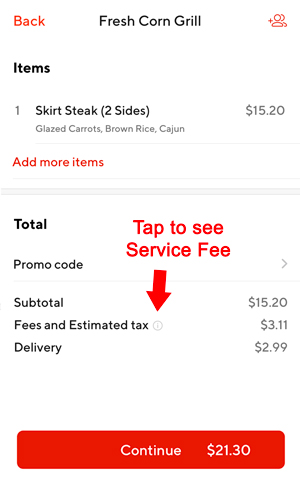

The forms are filed with the US. For those who use DoorDash multiple times per week the fees can begin to add up. As a result if you bought a 300000 home in January 2018 you would have to pay property taxes.

Additionally you will have to pay a self-employment tax. How Much Tax Do You Pay On Doordash. Dashers will not have their income withheld by the.

There is no fixed rule about this. A 1099-NEC form summarizes Dashers earnings as independent. How Do Taxes Work with DoorDash.

6 Ways to Avoid a Kittens For Sale In Las Vegas Nevada If your income exceeds 600 in a year only. Internal Revenue Service IRS and if required state tax departments. DoorDash does not automatically deduct taxes from your pay.

Yes - Just like everyone else youll need to pay taxes. That said the rule of thumb is to set aside 30 to 40 of your profits to cover state and federal taxes. You can figure this out by subtracting 11000-9701.

You still have to pay taxes if you made under 600 and didnt receive a 1099. It doesnt apply only to. Additionally you will have to pay a self-employment tax.

The membership allows you to get unlimited deliveries from many different restaurants with a. Now that you have everything you need to know about your 1099 tax deductions you may be wondering when your taxes are due. The main exception is if you made under 400 in.

The DoorDash website claims drivers can make up to 25 an hour which might be a stretch for most markets. Dashers are self-employed so they will pay the 153 self-employment tax on their profit. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes.

Solved You will owe income taxes on that money at the regular tax rate. If you earned more than 600 while working for DoorDash you are required to pay taxes. Then on the 9701-11000 dollars you would need to pay 12 of that.

How Much to Pay DoorDash Taxes. A 1099 form differs from a W-2 which is the standard form issued to. On top of that youll have to pay self employment tax 15 Does Doordash Take Out Taxes.

How Much Tax Do You Pay On Doordash. So on the first 9700 dollars you will pay 10 or 970 dollars in taxes. Solved You will owe income taxes on that money at the regular tax rate.

This is a flat rate for gig work so youll pay the same.

Cash On Delivery Overview And Faq

Doordash Delivery Strategies To Get Free Cheap Food Brought To You Save Money Shopping Cool Gifts For Kids Doordash

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

Comparing Self Employment Taxes To Income Taxes Self Employment Tax Is A New Things When You Become An Independent Contrac Student Jobs Federal Income Tax Tax

Doordash Hidden Tips Why Is It Happening What Can Dashers Do In 2022 Doordash Grubhub Tax Guide

No Free Lunch But Almost What Doordash Actually Pays After Expense Payup Doordash Algorithm Payroll Taxes

Doordash Driver Hack To Make More Money Make More Money Doordash Medical Supplies

Doordash Driver Canada Review 2022 How Much Does Doordash Pay

The Delivery Driver S Tax Information Series The Information Contained In This Information Series Is For Educational And Information In 2022 Doordash Business Tax Tax

Is Doordash Worth It 2022 Realistic Hourly Pay How To Sign Up

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

Updated Doordash Top Dasher Requirement Note That Popped Up In The Dasher App Promising Top Dasher Will Now Give You Priority In 2022 Doordash Dasher Opportunity Cost

Full Of Questions Label Over A Dasher S Fuel Guage But With Question Marks Indicating The Full And Empty Spots Doordash Tax Guide Dasher

Doordash Promo Codes Coupon Coding

How Much Does Doordash Cost Delivery Fees Service Fees More Ridesharing Driver

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver

Understanding These 9 Concepts Will Help You Understand How Taxes Work For Uber Eats And Other Gig Economy Deliver In 2022 Small Business Tax Business Tax Student Jobs